Originally posted by A350-XWB

View Post

Announcement

Collapse

No announcement yet.

Sri Lanka Aviation

Collapse

This is a sticky topic.

X

X

-

Sri Lanka govt to take-over state airlines debt; seek managing investor: PM

Apr 26, 2016 13:08 PM GMT+0530 | 0 Comment(s)

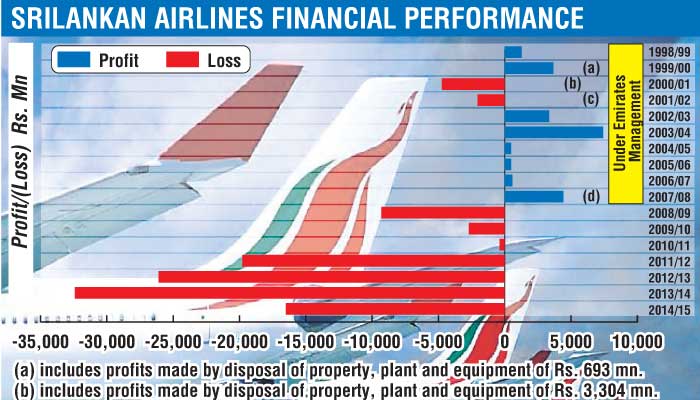

ECONOMYNEXT - Sri Lanka's government will strengthen the balance sheet of debt-ridden SriLankan Airlines by taking over some of its debt and seek a partner who can manage and invest in the airline, Prime Minister Ranil Wickremesinghe said.

SriLankan will also seek to cancel the four aircraft ordered from Airbus, where production has not yet started, he told reporters in Colombo.

He said SriLankan Airlines was a 'landmine' for the economy. SriLankan had total debts of 3.2 billion dollars, he said.

The government will have to take over debt and strengthen its balance sheet.

The government was seeking an international airline partner or an investor, Prime Minister Wickremesinghe said.

Request for proposals will be called he said.

Without reducing its debt, no partner will be willing to take it over, analysts say.

Minister Sarath Amugunugama said the cabinet of ministers had decided to seek an international partner to avoid having to close down the airline.

Prime Minister Wickremesinghe said some of the losses of budget carrier Mihin Lanka was hidden inside SriLankan and the two airlines.

Having a plan to fix the state airlines is believed to be a 'prior action' to under a strategy developed with the International Monetary Fund to fix Sri Lanka's broken state finances.

Sri Lanka's private credit grew 88.9 billion rupees in September 2024, on top of 135.1 billion rupees in August, while credit to government declined, official data showed.

Sri Lanka's private credit grew 88.9 billion rupees in September 2024, on top of 135.1 billion rupees in August, while credit to government declined, official data showed.

Mihin needs to be split from UL and a stake should be offered to a international low cost operator or investor like Indigo Partners. Genuine competition between 2 well managed airlines would be good for Sri Lankan aviation.

Comment

-

All of the above is just talk and wishful thinking imho.

Since the new GOSL was elected nothing whatsover has been done at UL.

Company culture - no change. No effort to change anything

Corruption/Nepotism - business as usual. No effort to do anything.

Investigations - going nowhere. Just more talk.

Not a single person has been arrested - former COO Druvi and HHR Pradeepa continue to be employed despite being guilty of abuse of power.

It's a disaster for the people of Sri Lanka while the Politicians, their family, friends and cronies pocket $$$ millions.

You cannot operate a business like this - you certainly can't ever make money.

Nobody will invest - what possible reason is there to get entangled in this mess? Easier to start anew Airline (cheaper too!).

Bankruptcy is the only option.Always fly a stable approach - it's the only stability you'll find this business

Comment

-

Mihin should be just shut down; better to have one bankrupt airline than two. I never understood the business case for Mihin other than having an airline in our old 'beloved leader's' name.Originally posted by lordvader View PostSri Lanka govt to take-over state airlines debt; seek managing investor: PM

Apr 26, 2016 13:08 PM GMT+0530 | 0 Comment(s)

ECONOMYNEXT - Sri Lanka's government will strengthen the balance sheet of debt-ridden SriLankan Airlines by taking over some of its debt and seek a partner who can manage and invest in the airline, Prime Minister Ranil Wickremesinghe said.

SriLankan will also seek to cancel the four aircraft ordered from Airbus, where production has not yet started, he told reporters in Colombo.

He said SriLankan Airlines was a 'landmine' for the economy. SriLankan had total debts of 3.2 billion dollars, he said.

The government will have to take over debt and strengthen its balance sheet.

The government was seeking an international airline partner or an investor, Prime Minister Wickremesinghe said.

Request for proposals will be called he said.

Without reducing its debt, no partner will be willing to take it over, analysts say.

Minister Sarath Amugunugama said the cabinet of ministers had decided to seek an international partner to avoid having to close down the airline.

Prime Minister Wickremesinghe said some of the losses of budget carrier Mihin Lanka was hidden inside SriLankan and the two airlines.

Having a plan to fix the state airlines is believed to be a 'prior action' to under a strategy developed with the International Monetary Fund to fix Sri Lanka's broken state finances.

Sri Lanka's private credit grew 88.9 billion rupees in September 2024, on top of 135.1 billion rupees in August, while credit to government declined, official data showed.

Sri Lanka's private credit grew 88.9 billion rupees in September 2024, on top of 135.1 billion rupees in August, while credit to government declined, official data showed.

Mihin needs to be split from UL and a stake should be offered to a international low cost operator or investor like Indigo Partners. Genuine competition between 2 well managed airlines would be good for Sri Lankan aviation.

It's a given that the government assumes some or most of UL's debts as a precursor for someone to take over. We had the same set of conditions set out IIRC when EK took over where the government had to fund the re-fleeting of the new airbuses (hope someone in the forum can clear whether or not there were some unwanted airbuses slipped under the guise of 'discounted aircraft').

Comment

-

Please note that news is mentioning the four A350s on direct orders going to be cancelled. So UL is most likely to receive three leased A350s. Hope UL will convert the four A350s to A320s instead of just cancel the order.Originally posted by TheF15Ace View PostWell can't say this was a surprise. Disappointing, but with the current situation it's the most realistic solution.

Comment

-

With 4 A350s out of the way, Mr Ratwatte must be eyeing on the opportunity to squeeze in a Bombardier C series order. Damn shameOriginally posted by banuthev View PostPlease note that news is mentioning the four A350s on direct orders going to be cancelled. So UL is most likely to receive three leased A350s. Hope UL will convert the four A350s to A320s instead of just cancel the order.

Comment

-

He'll try though I don't know how far he will get. From the article lordvader linked:Originally posted by dilushasg-bdavi View PostWith 4 A350s out of the way, Mr Ratwatte must be eyeing on the opportunity to squeeze in a Bombardier C series order. Damn shame

I assume ''the former Air Lanka and Emirates Airline pilot, retired Capt.Suhail Hashim, who is now a domiciled businessman in Canada.'' will be the middle man making a pretty penny courtesy of Sri Lankan tax payers if the Bombardier order happens.The pilots who were shell shocked by the CEO’s behaviour are also upset about a secret deal that has now come to light involving him, Chairman Ajith Dias, a soon to be recruited Chief Technical Officer Dinnaga Padmaperuma and former Air Lanka and Emirates Airline pilot, retired Capt.Suhail Hashim, who is now a domiciled businessman in Canada.Last edited by TheF15Ace; 27-04-2016, 02:22 AM.

Comment

-

I think the reason why UL is not taking up the 4 A359s is due to lack of funds, so I cannot see how changing the order to A320/A321 will help.Originally posted by banuthev View PostPlease note that news is mentioning the four A350s on direct orders going to be cancelled. So UL is most likely to receive three leased A350s. Hope UL will convert the four A350s to A320s instead of just cancel the order.

Assuming UL takes up the 3 frames currently in production, will they be sufficient to cover the LHR and NRT rotations?

Comment

-

I notice nobody wants to talk about how much the cancellation of 4 A350 will cost - another fiasco for the people of Sri Lanka.

Well with Clowns like this at the top it's a lost cause imho.

I have personally provided the Weliamuna Commission with letters and e-mails that prove abuse of power. Others have come forward as well.Always fly a stable approach - it's the only stability you'll find this business

Comment

-

It could help with mitigating the huge cancellation costs that Airbus will slap UL with if they fully cancel the order. Plus any future A320/1NEOs arriving around the early 2020s could replace existing narrowbody aircraft then. Not the ideal scenario but possibly one of the better ones at this present time.Originally posted by Cayman View PostI think the reason why UL is not taking up the 4 A359s is due to lack of funds, so I cannot see how changing the order to A320/A321 will help.

I remember reading an article that said that UL would be taking a fourth A350 in 2017. Hasnt been confirmed before so could be a typo.Originally posted by Cayman View PostAssuming UL takes up the 3 frames currently in production, will they be sufficient to cover the LHR and NRT rotations?

Also hope UL doesnt get the Bombardier C Series, would be a huge mistake IMHO. The A350s make much more sense IMHO.

Comment

-

LHR and NRT have been covered by the A333s haven't they? I don't think there is a range or payload restriction by these routes being operated by the A333?Originally posted by Cayman View PostI think the reason why UL is not taking up the 4 A359s is due to lack of funds, so I cannot see how changing the order to A320/A321 will help.

Assuming UL takes up the 3 frames currently in production, will they be sufficient to cover the LHR and NRT rotations?

Comment

-

Given that most of the monies owed to manufacturers are paid towards the delivery of the aircraft (unless UL has agreed to a different payment schedule) I assume that the SL government does not envisage future cash flow to be sufficient to cover these payments for A359s.Originally posted by lordvader View PostIt could help with mitigating the huge cancellation costs that Airbus will slap UL with if they fully cancel the order. Plus any future A320/1NEOs arriving around the early 2020s could replace existing narrowbody aircraft then. Not the ideal scenario but possibly one of the better ones at this present time.

Therefore, I am not sure if they will have cash flow to cover a possible narrow body acquisition either. Based on the information in the media, government wants UL to scrap the deal altogether to avoid future liabilities to make it more 'attractive' (if possible at all) to a buyer.

While Airbus is contractually able to impose a huge penalty, they are more likely to work with UL in a spirit of partnership to resolve the situation as they have done before with many other smaller airlines in financial difficulties. It all depends on how UL will approach their negotiations.

Amen!Originally posted by lordvader View PostAlso hope UL doesnt get the Bombardier C Series, would be a huge mistake IMHO. The A350s make much more sense IMHO.

Comment

-

I cannot be certain, but since the order was cancelled fairly early Airbus might not impose a cancellation penalty. But they most probably will keep the initial deposit made when the order was firmed.While Airbus is contractually able to impose a huge penalty, they are more likely to work with UL in a spirit of partnership to resolve the situation as they have done before with many other smaller airlines in financial difficulties. It all depends on how UL will approach their negotiations.

Comment

-

What do you think of UL using three leased A350 effectively like below.Originally posted by Cayman View PostI think the reason why UL is not taking up the 4 A359s is due to lack of funds, so I cannot see how changing the order to A320/A321 will help.

Assuming UL takes up the 3 frames currently in production, will they be sufficient to cover the LHR and NRT rotations?

Frame 1

Mon, Wed, Fri - CMB-LHR-CMB - DEP CMB 12:30 - ARR CMB 12:50+1

Tue, Thu, Sat, Sun - CMB-PEK-CMB - DEP CMB 14:25 - ARR CMB 09:05+1

Frame 2

Tue, Thu, Sat - CMB-LHR-CMB - DEP CMB 12:30 ARR CMB 12:50+1

Sun - CMB-LHR-CMB - DEP CMB 13:50 ARR CMB 14:20+1

Wed, Fri - CMB-PVG-CMB - DEP CMB 14:35 ARR CMB 08:05+1

Mon - CMB-PVG-CMB - DEP CMB 15:35 ARR CMB 09:00+1

Frame 3

Wed, Fri, Sun - CMB-FRA-CMB - DEP CMB 00:10 - ARR CMB 22:00

Thu, Sat, Mon, Tue - CMB-NRT-CMB - DEP CMB 00:15 ARR CMB 20:00

But this news say UL may not use any of the A350s. We need to wait and see what finally going to happen : http://www.ttrweekly.com/site/2016/0...-airbus-order/

Comment

-

By Uditha Jayasinghe Cabinet yesterday gave approval for the Treasury to absorb Rs.461 billion total liabilities of SriLankan Airlines and make it more attractive to an international partner as the Government continues on its efforts to form a joint venture. The national carrier’s total debt was calculated at Rs. 461 billion or $3.2 billion, which also includes payments fr ..

By Uditha Jayasinghe Cabinet yesterday gave approval for the Treasury to absorb Rs.461 billion total liabilities of SriLankan Airlines and make it more attractive to an international partner as the Government continues on its efforts to form a joint venture. The national carrier’s total debt was calculated at Rs. 461 billion or $3.2 billion, which also includes payments fr ..

Treasury to take over UL debt. Hopefully there is some serious restructuring as well to ensure this is not a regular occurence

Comment

Comment